trade finance rates

Understanding Trade Finance Rates: A Key to Smarter Global Business

In today’s interconnected economy, international trade is not just a business option—it’s a strategic necessity. But navigating cross-border transactions involves more than just exchanging goods or services. A critical component that determines profitability, especially for importers and exporters, is trade finance rates. These rates influence the cost of borrowing, the efficiency of supply chains, and the ability to manage working capital effectively.

This blog dives deep into the world of trade finance, explaining what trade finance rates are, how they’re determined, and what factors affect them. Whether you’re a startup looking to expand globally or a seasoned business owner seeking better terms, understanding trade finance rates is essential.

What Are Trade Finance Rates?

Trade finance rates refer to the interest rates, fees, and charges associated with financing international trade transactions. When companies import or export goods, they often rely on financing instruments such as letters of credit, trade loans, factoring, or supply chain financing. Each of these tools involves costs, and those costs are what we refer to as trade finance rates.

These rates are typically applied by banks, trade finance providers, and alternative lenders. The goal is to bridge the gap between a buyer receiving goods and the seller receiving payment. Trade finance ensures liquidity and reduces risk for all parties involved, but at a cost.

Why Trade Finance Rates Matter to Your Business

High or poorly negotiated trade finance rates can eat into profit margins and reduce competitiveness. On the other hand, favorable rates can boost cash flow, increase purchasing power, and strengthen supplier relationships. For companies operating at scale, even a small variation in rates can translate to substantial financial impact.

Additionally, understanding these rates enables better financial forecasting and budgeting. When trade finance is structured strategically, it can become a growth enabler rather than just a financial obligation.

Factors That Influence Trade Finance Rates

Several elements determine trade finance rates, and understanding them can help businesses negotiate better terms:

1. Creditworthiness of the Buyer or Seller

Just like with personal or corporate loans, the credit rating of the involved parties plays a major role. Banks assess the risk level before offering any trade financing, and higher risks often lead to higher trade finance rates.

2. Country Risk

Political stability, currency volatility, and economic conditions in the buyer’s or seller’s country can influence rates. Trading with a high-risk country may result in higher financing costs due to the increased likelihood of payment delays or defaults.

3. Type of Financing Instrument Used

Different instruments come with different cost structures. For example, a letter of credit may carry both issuance and confirmation fees, while supply chain financing might offer more competitive rates depending on volume and tenure.

4. Transaction Size and Frequency

Larger and more frequent transactions often lead to better-negotiated trade finance rates, thanks to economies of scale. Long-term relationships with financial institutions also tend to yield more favorable terms.

5. Currency Involved

If a transaction involves exotic or unstable currencies, lenders may charge higher rates to offset the risks associated with currency fluctuations.

How to Get the Best Trade Finance Rates

Getting competitive trade finance rates isn’t just about shopping around—it’s about presenting your business as a low-risk, high-value partner. Here are some practical tips to help secure better deals:

-

Improve Your Credit Profile: Work on maintaining a strong balance sheet, timely repayments, and robust cash flow.

-

Compare Multiple Offers: Don’t settle for the first quote. Use platforms and trade finance marketplaces to compare offers from banks and non-bank lenders.

-

Negotiate Terms: Many businesses don’t realize that trade finance rates are often negotiable. Be prepared to discuss terms and push for lower fees or interest.

-

Leverage Technology: Fintech platforms can help streamline trade finance operations and sometimes offer lower rates due to automation and lower overheads.

-

Work with Trade Finance Advisors: If you’re unfamiliar with the nuances of trade financing, consider consulting with an expert to structure the best possible deal.

Trends in Trade Finance Rates in 2025

The landscape of trade finance continues to evolve, influenced by global economic shifts, regulatory changes, and technological innovation. Here are some trends impacting trade finance rates in 2025:

-

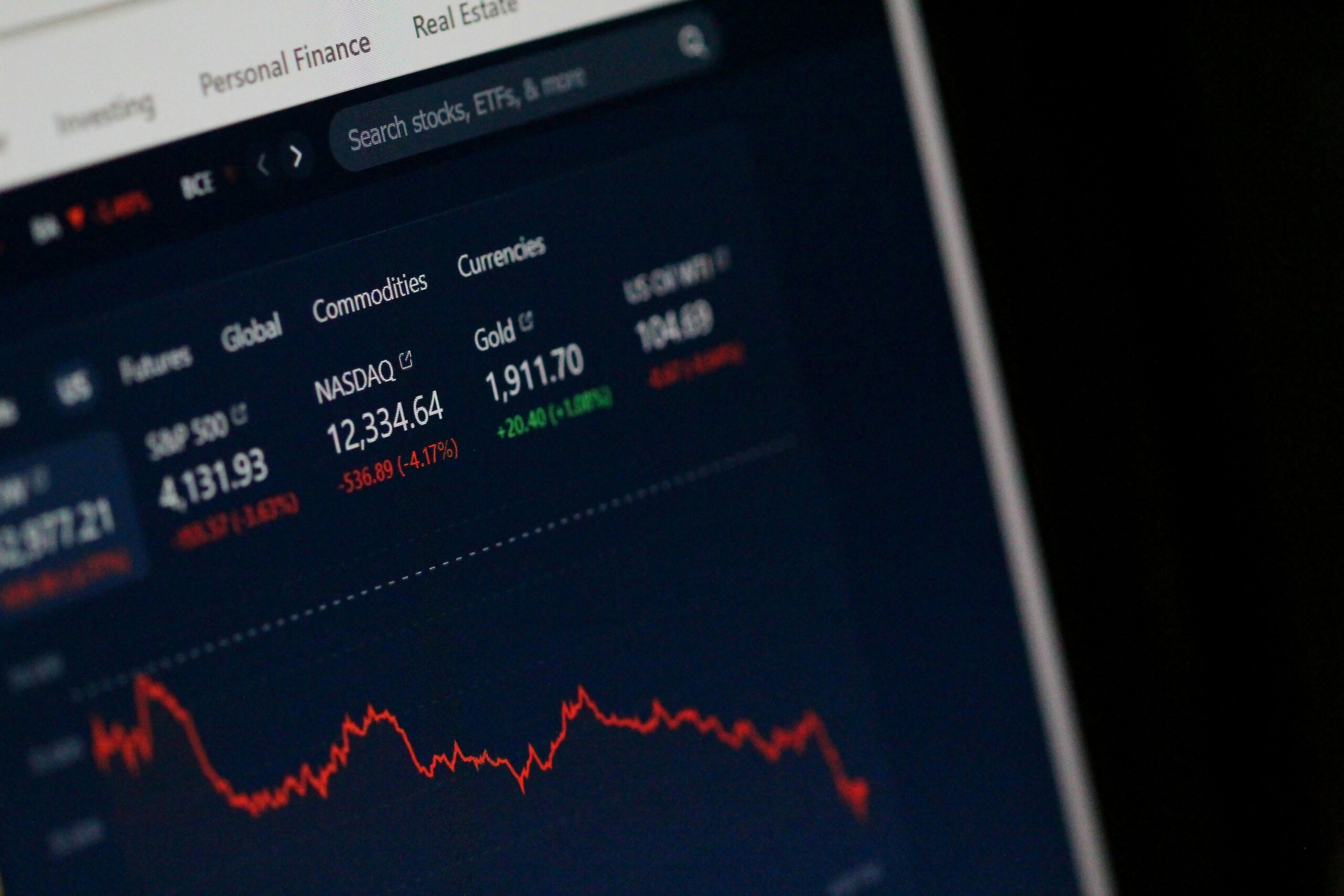

Rising Interest Rates Globally: With central banks adjusting base rates to tackle inflation, trade finance rates have also seen an uptick. Businesses need to account for this in their cost planning.

-

Increased Role of Fintech: Alternative lenders and fintech firms are offering competitive trade finance solutions, often at lower rates than traditional banks.

-

Green Trade Finance: Sustainability-focused financing is gaining traction, and some lenders offer lower trade finance rates for companies with strong environmental, social, and governance (ESG) practices.

-

Greater Use of Blockchain and Smart Contracts: These technologies reduce risk and processing times, often resulting in more attractive financing costs.

Staying on top of these trends ensures that your business remains agile and competitive in the global market.

Conclusion: Make Trade Finance Rates Work for You

Trade finance rates are more than just a cost of doing international business—they’re a lever you can use to enhance profitability, efficiency, and strategic growth. The key is to understand how these rates work, what affects them, and how to negotiate better terms.

In an increasingly complex global market, businesses that master the intricacies of trade finance are more likely to succeed. Whether you’re looking to expand your supply chain, enter new markets, or simply improve your working capital management, keeping a close eye on trade finance rates can offer a distinct competitive edge.

Final Tips:

-

Stay informed about global interest rate trends.

-

Build strong relationships with financial partners.

-

Invest in financial tools or advisors that specialize in trade finance.

By taking a proactive approach, your business can turn trade finance into a powerful asset—rather than a liability.